Renters Insurance in and around Santa Clarita

Santa Clarita renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- Santa Clarita

- Valencia

- LOS ANGELES COUNTY

- VENTURA COUNTY

- KERN COUNTY

- ORANGE COUNTY

- SAN DIEGO

- RIVERSIDE COUNTY

- SANTA ROSA

- SACRAMENTO

- SAN BERNARDINO

- SANTA BARBARA COUNTY

- MONTEREY COUNTY

- FRESNO COUNTY

- TULARE COUNTY

- KINGS COUNTY

- IMPERIAL COUNTY

- Newhall

- Canyon Country

- Saugus

- San Clemente

- Castaic

- Agua Dulce

- Piru

Protecting What You Own In Your Rental Home

It may feel like a lot to think through work, your sand volleyball league, family events, as well as coverage options and savings options for renters insurance. State Farm offers hassle-free assistance and impressive coverage for your clothing, musical instruments and tools in your rented condo. When the unexpected happens, State Farm can help.

Santa Clarita renters, State Farm has insurance for you, too

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

Renters insurance may seem like the least of your concerns, and you're wondering if it's really necessary. But pause for a minute to think about how difficult it would be to replace all the valuables in your rented townhome. State Farm's Renters insurance can help when windstorms or tornadoes damage your personal property.

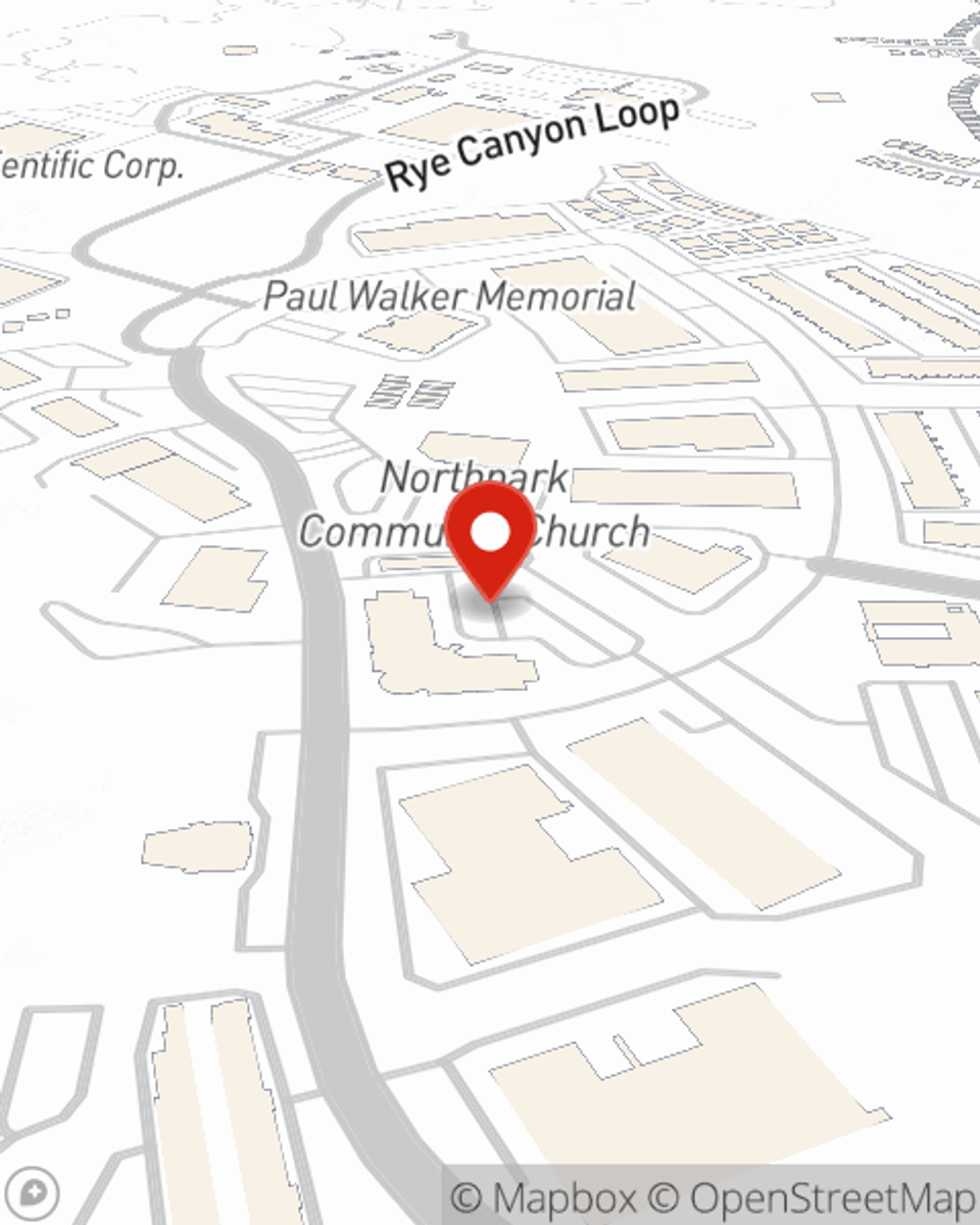

As a trustworthy provider of renters insurance in Santa Clarita, CA, State Farm strives to keep your life on track. Call State Farm agent Kirk Baker today for help with all your renters insurance needs.

Have More Questions About Renters Insurance?

Call Kirk at (661) 255-2900 or visit our FAQ page.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.